Cash is not king…

One matter that I discuss with clients, friends and family on a regular basis is the ever more difficult hunt for the best interest rate on personal cash. The truth is that I use the same best buy tables that are available to everyone else and therefore I can rarely add any value when it comes to recommending bank deposits.

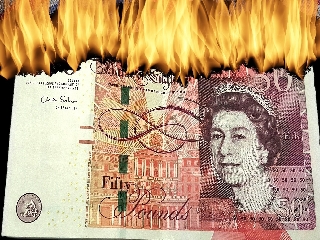

With there being little sign of any improvement in cash returns over the short to medium term, I always remind clients that as with any asset class, cash deposits are not risk free; the biggest risk to cash held on deposit is the inflationary risk.

Cash returns relative to inflation over the last ten years have been abysmal; cash has fallen by 21% over this time period relative to inflation (measured by RPI). This is not of course an absolute fall, but a real fall, i.e. in respect of the amount of goods or services that can be bought. In very simple terms if a cash deposit is earning 1.0% per annum in interest but inflation continues at 3% per annum the value of the cash is falling in real terms by a rate of 2% per annum.

I was astounded to read some recent research which highlighted that cash is the most popular long term investment for millennials. This is just criminal in my eyes. It is the one asset class you are guaranteed to lose money in. The most famous investor, Warren Buffett, agrees and has previously commented ‘The one thing I will tell you is that the worst investment you can have is cash. Cash is going to become worthless over time but good businesses are going to be worth more overtime’.

I understand, as a mum and a working family, that cash gives you that feeling of safety and security in the short term but longer term it doesn’t help you meet your objectives (unless of course you want to lose money!) or your financial freedom.

I must make it clear that there is absolutely no alternative to an accessible cash account for an ‘emergency fund’ i.e. the money that may be called upon in the short term. However I am regularly discussing alternatives for clients’ other surplus cash to provide opportunities for returns above the rate of inflation over the long term, and it is almost never my recommendation to use cash as a long term investment.

Alternatives to cash carry other risks, and volatility should be expected. However, a competent adviser will help a client understand the concept of risk; they will analyse their attitude towards investment risk to ensure an alternative solution is both suitable for the clients’ individual tolerance and capacity for loss, whilst being better positioned to provide opportunities for growth over the long term. The approach and indeed solution will be specific to the individual and it will change over time, but an adviser will revisit the discussion at every opportunity to ensure that the level of risk remains appropriate.

laura.ripley@michaelambrose.co.uk