MARKET UPDATE

Arguably the biggest single event to affect markets since our last newsletter in November was the collapse of four banks. Three of these were medium sized US banks (Silicon Valley Bank [SVB], Signature and First Republic), but the other was the European giant, Credit Suisse.

The collapses were caused by depositors becoming worried about the security of their capital and withdrawing cash en masse. In scenes reminiscent of Northern Rock in the UK in 2007, the banks were unable to raise cash quickly enough.

The initial concerns arose because medium sized banks were able to value their government bonds on the assumption that they would be held to maturity, i.e. the value quoted on the balance sheet was the value that would be paid at that future date. However the value at which the bonds (loans to governments) could be sold prior to maturity was far less. This is because the bonds had been issued when interest rates were much lower meaning the subsequent increase in interest rates caused the early sale values to fall, in many cases by substantial margins.

The falls were not gradually reflected on the banks’ balance sheets as they arose, but instead the final redemption value was shown, giving an artificially high valuation. At the same time this was occurring we saw a number of technology firms, which made up a large proportion of SVB clients, needing to draw down on liquidity in response to rising rates. The need to raise cash forced SVB to sell off some of their bonds at the market rate, crystallising the falls and alerting investors to the true position. This in turn caused a run on SVB which subsequently spread to the other banks detailed above. Interestingly, UK banks are required to value to market at all times and so, in theory, this ought not to happen here.

Following the United States response to the 2008 banking crisis, we saw banks with more than $50bn in assets become subject to additional oversight. This was designed to prevent the events seen in March. However the then President Donald Trump signed into law an amendment raising this threshold to $250bn, releasing SVB from the scrutiny that should have prevented this situation.

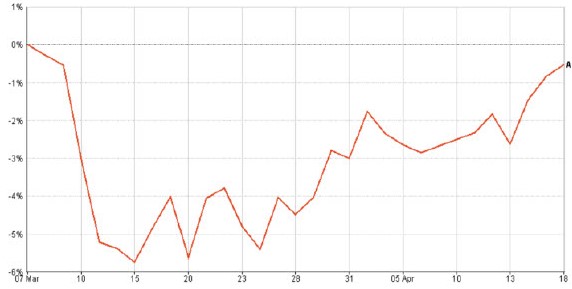

Markets fell heavily in response to the failures, partially caused by fears of a repeat of the banking crisis 15 years ago. However prompt action by governments, regulators and central banks enabled the situation to be contained, and indeed some banks (including UBS and HSBC) arguably bought valuable assets at exceptionally low prices. Within five weeks of the initial falls equity markets had recovered the majority of their value, as shown in the chart below:

The chart shows a low cost fund tracking the MSCI World Index, and it covers the period from early March to mid-April. It can be seen that a fall of nearly 6% occurred within a week but that this had been almost entirely recovered by the end of the period.

Markets have now largely moved on from this incident and prices have instead reverted to being driven by inflation and interest rate speculation, i.e. whether US interest rates have peaked and will fall later this year and how much further UK rates have to rise. As always there are differing opinions on timescales, but there is no doubt that the US is ahead of the UK in bringing inflation under control.

That said, the UK inflation rate is expected to drop markedly next month. This is because in April the inflation rate compared energy prices between March 2022 and March 2023. The large rise during March 2022 resulting from the invasion of Ukraine has therefore been a large contributor to inflation. However next month we will measure prices from April 2022, when energy prices had already risen significantly. The rise from that point to current levels is much lower, meaning the energy contribution to inflation will be substantially less. The Ofgem tariff cap increases over the period means that energy prices rose by 96% from March to March, but ‘only’ by 27% from April to April (source Institute for Fiscal Studies).

Taxing Times

There have been a number of significant changes to taxation which are now being felt. These include, but are not limited to:

– The reduction of the capital gains tax allowance from £12,300 to £6,000 per annum, with a further reduction to £3,000 taking place from April 2024.

– The freezing of the personal income tax allowance and an increase in people falling into higher rate tax brackets.

– The reform of the taxation of the self- employed and those in partnerships. This affects those whose trading periods do not fall in line with the normal financial year.

– An increase in the standard rate of corporation tax to 25%, and an increase in the rate of personal tax on dividends.

With the high level of borrowing undertaken by the government, at first in response to the banking crisis in 2008 and then to the pandemic, it seems unlikely that the tax burden will reduce in the short term. Indeed it has been announced that many tax allowances have been frozen for several years to come. One such allowance is the inheritance nil rate band, which has remained unchanged since 2010/11 and will not be increased until at least 2026.

That said, the Chancellor has announced the removal of the Lifetime Allowance for pension purposes, as well as an increase in the maximum pension contribution permitted each year.

These changes introduce complexity but also provide some opportunities. We will of course take account of the changes when carrying out reviews for individual clients, but if you have any concerns or wish to discuss any of the changes beforehand then please do let us know.

FINAL NOTE

The purpose of this newsletter is to provide a commentary for general interest purposes. It is not intended to provide recommendations, or to provide a deep technical analysis. If you would like more detailed information, or have any questions regarding your individual portfolio, then please speak to your usual adviser. Thank you.