MARKET UPDATE

What a difference a year makes! It was only November 2020 when Pfizer became the first pharmaceutical company to announce the successful development of a covid vaccine. AstraZeneca and others followed suit, and less than twelve months since the global roll out programme began, the world has now delivered 7.8 billion doses.

Covid is clearly far from defeated, but the vaccine roll-out has allowed most developed countries to return to some semblance of normality in day to day living.

There are of course recent exceptions, such as the latest lockdown in Austria, but there is genuine optimism that by spring we could be moving towards a situation where covid can be largely managed by medical science. There will of course sadly still be victims, as we see each year with influenza, but investment markets have reacted with extreme positivity to the progress since the first vaccine results were made public.

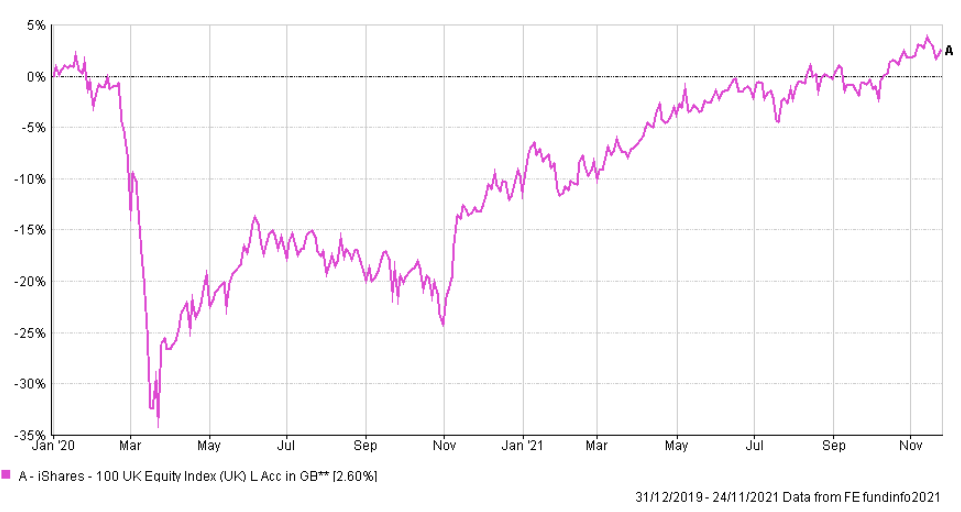

In the eleven months to the beginning of November 2020 we saw a low cost fund, tracking the UK FTSE 100 index, fall by -23%. The release of the Pfizer vaccine trial data triggered an immediate bounce, with the UK market recovering 13% in the month of November alone. The trend since then has been steadily upwards, and this is shown in the chart below which covers the period from 1 January 2020 to date.

Despite this recovery, the UK has underperformed most major markets over this period, most notably the United States. Part of this is attributable to the loss of international confidence in the UK as a result of Brexit, but a larger part is down to the domination of technology stocks in the US, an area of the market to which the UK has relatively little exposure.

Despite this recovery, the UK has underperformed most major markets over this period, most notably the United States. Part of this is attributable to the loss of international confidence in the UK as a result of Brexit, but a larger part is down to the domination of technology stocks in the US, an area of the market to which the UK has relatively little exposure.

Despite the fact that technology has been a clear winner from the pandemic, there is an argument that many UK companies currently look attractively priced compared to their overseas peers. This is certainly the view of a number of private equity firms, as we have seen large numbers of takeovers in recent months. Morrisons is one example of a takeover deal currently being pursued.

For this reason we see the UK as being attractively priced relative to overseas peers in the short term, though portfolios do of course continue to have a balanced approach for diversification purposes.

INFLATION

Whilst covid has obviously dominated markets’ attention for the best part of the past two years, in recent weeks inflationary pressures have come to the fore. This month saw the Consumer Prices Index record an increase of 4.2% over 12 months, and the little reported Retail Prices Index rose by 6%.

Increases such as these have the most impact on those with fixed incomes (typically pensioners) and those with large cash deposits. With interest rates so far below inflation the real value of cash savings is now falling quite rapidly, as illustrated in the chart below:

This chart shows the real return (i.e. inflation adjusted) of a competitive 90 days’ notice savings account, after adjusting for inflation as measured by the Retail Prices Index. The chart shows a five year period. Over this relatively short period cash has lost 12% of its purchasing power.

The Bank of England is predicting that inflation will continue to rise, with a forecast that the Consumer Prices Index may reach 5% by next spring. This will exacerbate the situation for savers as whilst interest rates may start to rise, they are unlikely to reach more than a small fraction of this rate.

Clearly all of us need cash to meet short term expenses that may arise, but the chart above illustrates the danger posed by inflation and explains why we continue to only hold appropriate levels in portfolios.

COP26

The UN Climate Change Conference recently took place in Scotland, with world leaders meeting to discuss how to combat rising temperatures. This topic is of course increasingly impacting on our daily lives, but it is also changing the financial services industry. There are now increasing numbers of funds which limit their investments to only acquiring shares in companies which have a net benefit to society. Not only does the deployment of capital in this way cause companies to think about their strategy going forwards, but it also provides funding for others to innovate.

We routinely ask clients if this topic is one they wish to take account of in their portfolio construction, and it is something we are happy to incorporate where required.

As a firm, Michael Ambrose Limited is also taking steps to reduce its own carbon footprint. Beyond the usual energy efficiency matters, we are also focused on reducing the mileage our advisers travel each year. Meetings with fund managers, that previously took place at conferences and in person, are increasingly arranged via video calls.

An increasing number of our client meetings are also taking place via video calls. Many of us have become proficient at using this technology whilst talking to friends and family through lockdown and are now comfortable in using Zoom or Teams. Whilst there is an undoubted benefit of meeting face to face, where we are able to avoid unnecessary road journeys, we will seek to do so. Please rest assured that we will continue to offer ‘in person’ meetings where appropriate or where this is the preference of the individual client.

FINAL NOTE

The purpose of this newsletter is to provide a commentary for general interest purposes. It is not intended to provide recommendations, or to provide a deep technical analysis. If you would like more detailed information, or have any questions regarding your individual portfolio, then please speak to your usual adviser. Thank you.