MARKET UPDATE

Our last newsletter was issued in November 2020, and this focused on the positive sentiment that the successful vaccine trials were generating for markets. Since that time, the NHS has made massive progress in vaccinating the UK population, with 36m people now having received their first dose and 20m also having had their second. In total 90% of people aged 40 and over have now had their first vaccine.

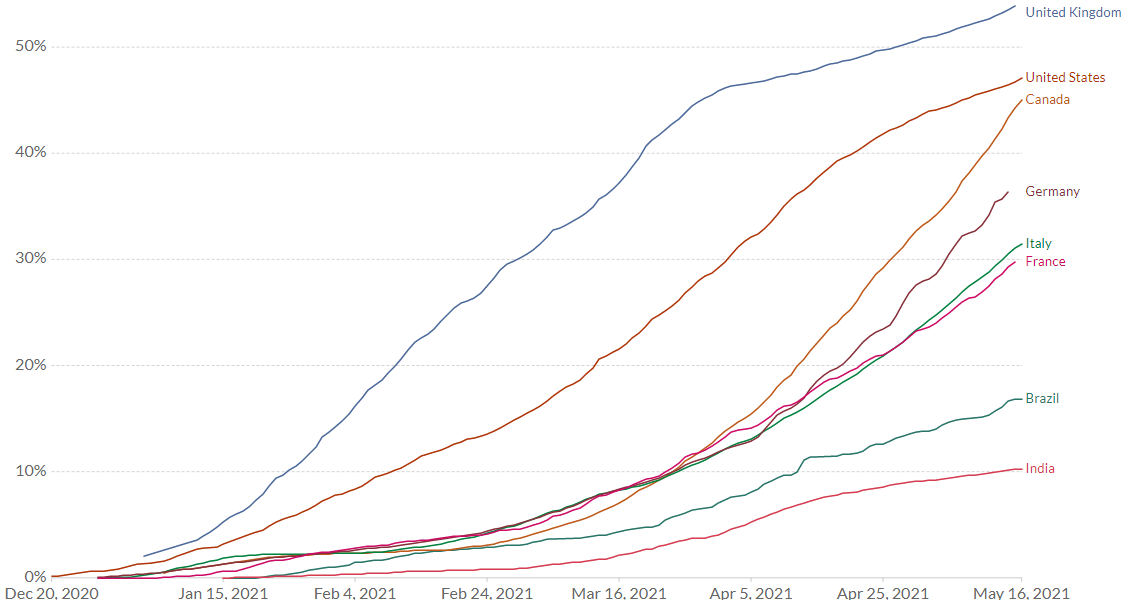

Whilst the UK is well ahead of most other developed markets, other countries are making rapid progress following a slow start. This can be seen in the chart below.

The successful role out of the vaccine has led to the relaxation of lockdown rules both at home and abroad, and this is expected to prove beneficial for the economy and those companies previously worst hit. Hospitality, travel and tourism are all set to benefit along with indirect sectors such as oil.

The UK stock market lagged most of its global peers in recent years, but the success of our vaccine roll out combined with optimism that some of the worst hit sectors (which feature significantly in the UK stock market) could perform well has resulted in the domestic market outperforming for the first time in a number of years. Over the last six months we have seen the largest UK companies record average gains of +12%.

Europe (another market which previously underperformed in relative terms) saw similar gains, though marginally lower, but those economies where the roll out is slower have not performed as well. Asia and Japan are examples of this, and whilst the former did record a 5.1% gain, Japan actually fell by 2% in sterling terms.

There has been much written about the ‘accidental savings’ accrued during lockdown, and Fidelity International recently released research showing the women in the UK had saved an average of £2,381 since the first lockdown in March 2020 (including an average of £352 on haircuts, £289 on clothes and £179 on coffee and shop bought lunches), whilst men accrued around £1,116. Collectively this is a substantial sum, and figures from the Office for Budget Responsibility show that UK households deposited £148 billion in the first three quarters of 2020 compared to just £45 billion in the preceding three quarters.

It is speculated that a large part of these savings will find their way into discretionary expenditure, and markets have risen in anticipation of this. However, a substantial increase in demand for goods comes at a time when there is a shortage of such goods. This is because of a fall in production during lockdown as well as difficulties in importing some goods and raw materials post Brexit.

Proportion of Population who have received at least one COVID-19 Vaccine

A combination of reduced supply and high demand will inevitably lead to higher prices, and markets are currently assessing the inflationary risks. UK inflation rose to 1.5% in April from 0.7% in March, and there is a consensus that we could see inflation of 3.5% to 4% by the end of this year. Certainly some commodities have seen considerable increases from the 2020 lows, including corn rising by 148%, sugar by 90% and lumber by a staggering 508% (source: Bloomberg and Datastream).

Concerns about inflation have led to a sell off in bonds in the early part of 2021, with this asset class seeing the worst quarterly return since 2008. In the UK, we have seen the government borrowing rate on ten year debt rising from 0.25% per annum in January to 0.9% at the time of writing.

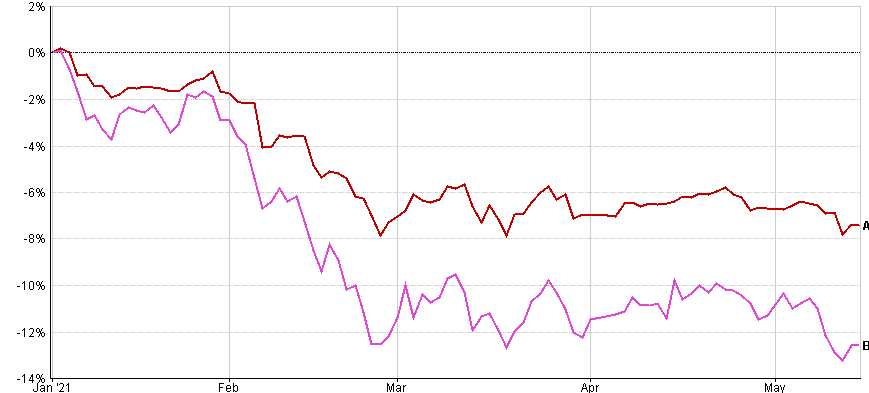

Whilst this may not sound a significant increase, small increases can have a significant impact on returns. The longer the term of the loan (known as Gilts) the greater the capital loss than can be incurred. This can be seen in the following chart which plots the returns of a Fidelity fund tracking all UK Gilts (in red) alongside a Vanguard fund which tracks long term Gilts only (in pink).

The scale of the chart is not easy to read, but the two funds have fallen by -7.4% and -12.6% respectively. The maximum profit anyone buying a ten year Gilt in January could have made by holding the loan to redemption was just +2.5%, and it can therefore be seen that the trade off between risk and reward is not proportionate.

Fortunately corporate debt has proven more resilient than government debt, but the same risks do apply.

COVID ARRANGEMENTS

It is pleasing that we have managed to maintain normal operations during the pandemic, and whilst we have of course had to adapt working practices to reflect the situation, we have remained available to handle queries and process investment changes throughout 2020 and 2021.

As the restrictions in place start to lift we are making arrangements to revert to holding face to face meetings, and we plan to fully re-open our office when the fourth step out of lockdown is reached. This is scheduled for 21 June.

Video meetings have of course become part of most people’s lives, and we will continue to offer this as an option for clients as an alternative to telephone calls or in person meetings. Whilst our expectation is that most meetings will revert to being carried out in person, we recognise that video meetings are a very useful option to have. A number of clients have expressed a wish to cut down on unnecessary travel for environmental reasons, and we will continue to work on the basis that best suits each individual. Please do therefore let your adviser know your preference in this regard.

FINAL NOTE

The purpose of this newsletter is to provide a commentary for general interest purposes. It is not intended to provide recommendations, or to provide a deep technical analysis. If you would like more detailed information, or have any questions regarding your individual portfolio, then please speak to your usual adviser. Thank you.